Block Bids - A new approach for the allocation of long-term transmission rights

Overview

Background & purpose

Long-Term Transmission Rights (LTTRs) are commonly used by market participants to hedge their cross-border electricity transactions. During the Market European Stakeholder Committee meeting of 17 June 2020, some market participants requested that alongside the already existing standard LTTR-products for the yearly and monthly timeframe, a further LTTR allocation approach is considered in order to individualise hedging strategies and to align them to flexible market conditions – the so-called “block bids” approach.

This consultation aims at identifying to which extent this new approach is considered useful or even necessary by market participants. As a starting point, single “blocks” would have a duration of one calendar month. The idea would be to allocate a number of standard monthly LTTR products simultaneously already at the end of the year ahead of the delivery in addition to the existing month-ahead and year-ahead allocations (which are run in parallel, but separately).

Products

Existing (for information):

- Year-ahead yearly products:

- Duration: year Y

- Auction timing: at least once in Y-1

- Month-ahead monthly products:

- Duration: one month M of year Y

- Auction timing: M-3 and/or M-2 and/or M-1 (practices differ from CCR to CCR).

- Quarterly/seasonal/weekly/week-end/other products (where applicable, differs from CCR to CCR):

- Duration: one quarter/season/week/week-end/other

- Auction timing: throughout Y-1 before delivery/9 months before/M-1/W-1/other

New:

- Year-ahead monthly products (“block bids”):

- Duration: one month M of year Y

- Auction timing: at least once during Y-1, for each month one separate auction in the year preceding the year of deliver

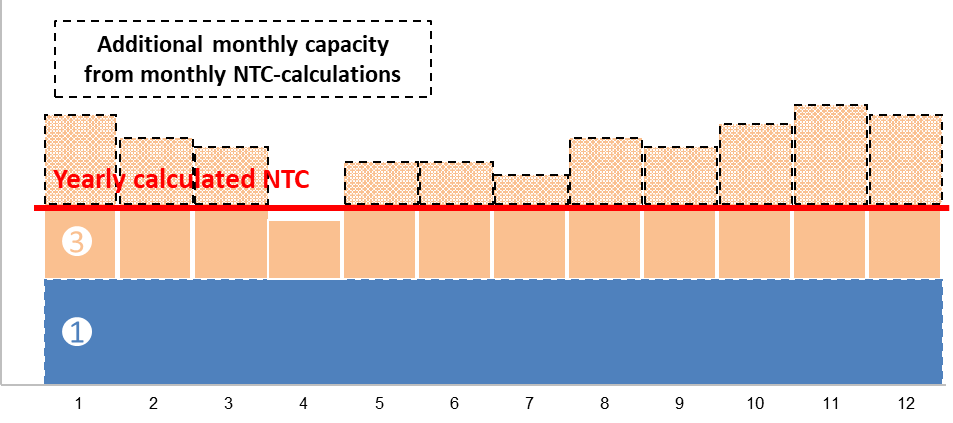

Current allocation structure of LTTRs

- The NTC profile calculated y-1 (red line) in the graph is indicative and may not be flat for all the regions (possibility of reduction periods).

- As indicated in month 4, the monthly NTC calculations may not result in additional capacity to the NTC profile calculated y-1 and may result in lower values than the yearly NTC calculations, even zero monthly NTC (where there would be no “orange rectangle”)

- A baseload annual product (including reduction/reservation periods where applicable) is sold in the year-ahead timeframe (item 1 on the graph);

- A reservation is made (according to the Splitting Rules) for monthly products to be allocated month/s ahead on a monthly basis throughout year Y (item 3 on the graph);

- Please note that in month 4 an extraordinary situation is shown, where monthly NTC calculation resulted in lower values than NTC calculated in the yearly timeframe. In consequence there is no additional monthly calculated NTC and part reserved for monthly allocation based on splitting rules need to be reduced to monthly calculation level – but still there in no need for curtailment.

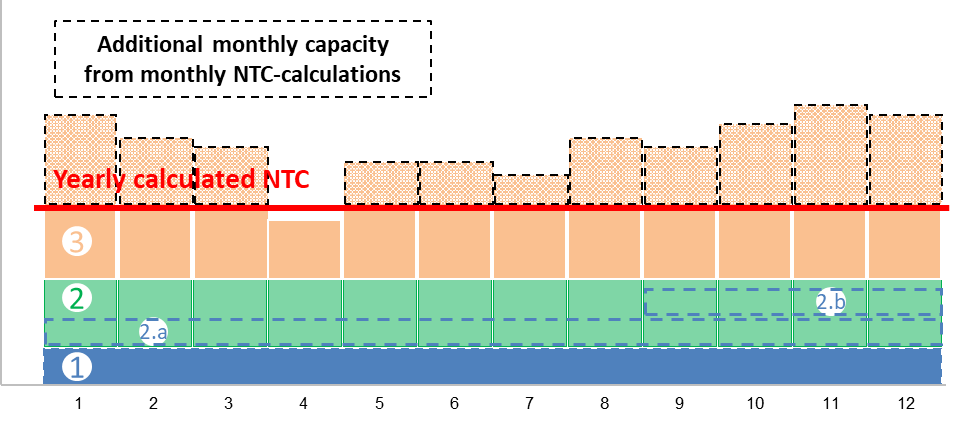

Block bids within the current structure of LTTRs

- The distribution of the bars and colours would depend on the regional Splitting Rules.

- The long-term NTC profile would be auctioned through monthly blocks (items 2 in the graph);

- Market participants would be able to bid for single monthly blocks separately in advance (i.e. at yearly auctions at the end of the year ahead of the delivery) so as to form custom-made hedging profiles based on their bidding structure for monthly bids, but still depending on the auction results (items 2.a and 2.b in the graph);

- A thinner annual baseload product shall still be offered (item 1 in the graph);

- A reservation for a certain (minimum) share of standard monthly products allocated in the month-ahead timeframe should be maintained, to further guarantee the ability for market participants to hedge closer to real time (item 3 on the graph);

- Please note that like in the first graph in month 4 the extraordinary situation is shown, where monthly NTC calculation resulted in lower values than NTC calculated in yearly timeframe. In consequence there is no additional monthly calculated NTC and part reserved for monthly allocation based on splitting rules need to be reduced to monthly calculation level – but still there in no need for curtailment.

Auction process and pricing

- At least once during Y-1 :

- The year-ahead monthly products would be put to auction. 12 simultaneously / one-by-one auctions would be held for each border where actors can bid for each month of the year. Each of these 12 auctions would be held autonomously, i.e. bidders cannot make interrelated (or “conditional”) bids across several auctions, they need to act independently on each auction. 12 prices would therefore be formed for each of the months as the results of the bidding processes in the 12 separate auctions;

- The year-ahead yearly products would continue to be offered in an auction in the same way as the yearly products are currently sold on many EU BZBs.

- Course of M-1:

- The month-ahead monthly products (capacity set aside beforehand for this product plus any possible additional month-ahead capacity arriving from capacity calculation and returned capacity from preceding LT auctions) would continue to be auctioned in the same way as the monthly products are currently sold on many EU BZBs.

Benefits of the block bid approach

- Hedging would remain flexible and adaptive to market conditions at the time of auctions;

- Market parties would have additional flexibility to hedge their specific needs by combining monthly blocks up to already one year ahead;

- Capacity may be mostly valued on a monthly basis, which perhaps better reflects the hedging value of the allocated capacity. With this new block bids approach, as more capacity will be priced with a monthly granularity, TSOs might receive a congestion rent better reflecting its hedging value;

- TSOs potentially are able to immediately put on the market a large share of the long-term NTC profile (if regional Capacity Calculation enables such possibility) that they have calculated for the year to come. This would depend on implementing the regional Splitting Rules.

Drawbacks and challenges

- Adaptations could be needed in certain methodologies and rules (Splitting Rules, LTTR design, HAR, LT CCM, etc.);

- The development and implementation of such a mechanism will require adaptations in the SAP’s, TSO’s and market participants’ IT systems at additional cost for grid tariff payers;

- There could be less standard yearly and/or monthly products offered (and possibly allocated) in the year-ahead and month-ahead allocation timeframe (depending on which reservation is made for them in the initial design), since capacity allocated through block bids cannot be allocated to standard products, and vice-versa – liquidity (interest/demand of market participants and offer of products) can be limited;

- There could be an impact on secondary trading, to be identified;

- Monthly blocks sold one year ahead will be part of the yearly-calculated NTC, which already takes into account the risks and contingencies associated to the LT timeframe. However, if an unforeseen event beyond the LTCCM assumptions happens, the amount of capacity exposed to the risk of being curtailed could increase, since it might be the case that by including the monthly blocks more capacity is provided to the market one year ahead than with the yearly base-load product alone – based on the same calculation results;

- Possible needs to adapt collateral limits.

Implementation considerations:

- While the structure of this mechanism would need to be established at the pan-EU level, its implementation should be decided at the CCR or where applicable at Interconnector level. It would be left to each CCR / Interconnector to choose the best mix between standard yearly and monthly auctions and the new block bids approach;

- This block bids mechanism should be compatible with both cNTC and Flow-Based LT CCMs and allocation mechanisms. The interaction between FB and block bid features has not yet been scrutinized and could be an attention point in terms of complexity/delivery time.

Why your views matter

TSOs and NRAs have jointly developed this consultation following the demands from the market participants expressed in the MESC meeting of 17 June 2020 for additional LTTR-products for the yearly and monthly timeframe, to individualise hedging strategies and to align them to flexible market conditions.

Audiences

- ENTSO-E stakeholders

Interests

- Market Network Codes

Share

Share on Twitter Share on Facebook